Benchmarking Research Group – BERG

1. Introduction

The Benchmarking Research Group (BERG), affiliated with the Faculty of Accounting, was established under Decision No. 382/2018/TĐT-QĐ dated March 13, 2018, issued by the President of Ton Duc Thang University (TDTU).

BERG focuses on applying the Data Envelopment Analysis (DEA) method, a non-parametric approach to evaluate the performance of complex business processes.

DEA is considered one of the most powerful tools for measuring efficiency, as it provides a comprehensive analytical framework that accounts for multiple factors influencing business operations. At the same time, DEA emphasizes the importance of timely solutions to real-world business challenges.

To date, BERG has successfully completed the first phase of its five-year project, achieving several notable accomplishments. The group is currently in the process of implementing the objectives set forth for the second phase of the five-year plan.

2. Vision and Mission

Our vision is to develop BERG into a leading research group in Vietnam specializing in in-depth studies on Data Envelopment Analysis (DEA), with a particular focus on practical applications and solutions related to topics in accounting and finance.

Our mission is to publish a wide range of research findings that offer a global perspective in the field of performance management.

3. Research Topics

- Performance measurement

- Corporate strategy

- Corporate and human governance

- Behavioral accounting and finance

5. Members of BERG

|

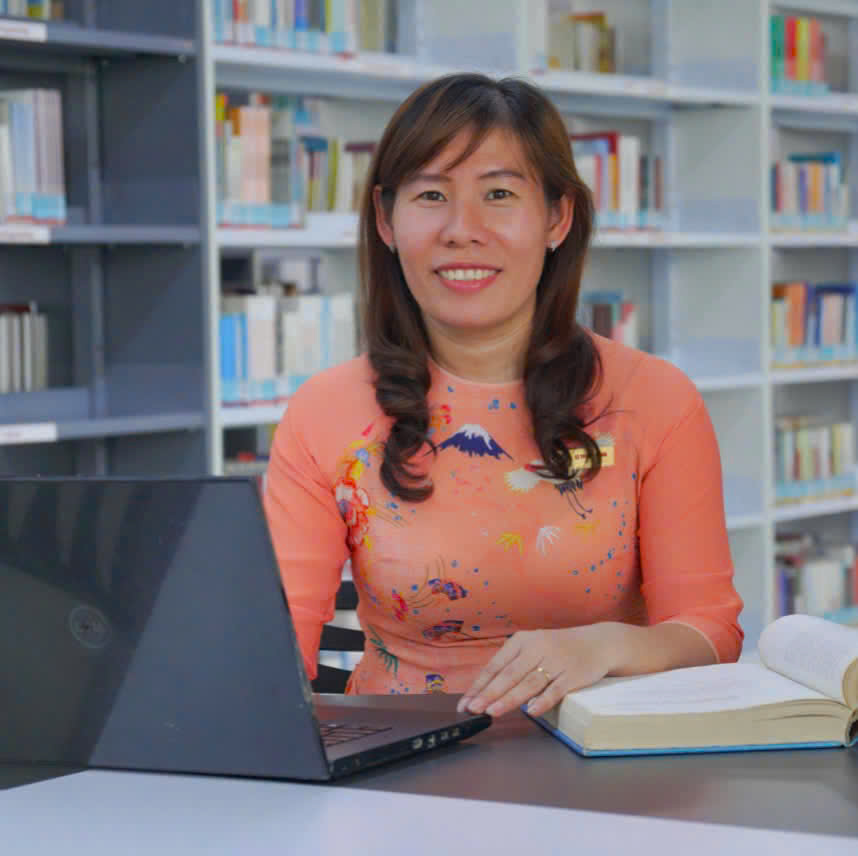

Assoc. Prof. Le Thi My Hanh Head of the Research Group Affiliation: Email: lethimyhanh@tdtu.edu.vn |

|

Prof. Qian Long Kweh Member of Research Group Affiliation: School of Management of Canadian University Dubai, United Arab Emirate Adjunct Professor, Researcher at the Faculty of Accounting, Ton Duc Thang University (TDTU) Email: qlkweh@gmail.com |

|

|

Prof. Irene Wei Kiong Ting Member of Research Group Affiliation: Head of QS University Rankings, Faculty of Industrial Management, Universiti Malaysia Pahang (UMP), Malaysia Adjunct Professor, Researcher at the Faculty of Accounting, Ton Duc Thang University (TDTU) Email: irene@umpsa.edu.my |

5. Notable Publications in the Past Five Years

Kweh, Q. L., Ting, I. W. K., Lu, W. M., & Le, H. T. M. (2025). Controlling Interest and Firm Efficiency: Comparing Family‐and Nonfamily‐Controlled Taiwanese Cultural and Creative Industry Firms. Managerial and Decision Economics, 46(2), 1344-1357.

Ren, C., Ting, I. W. K., Kweh, Q. L., & Le, H. T. M. (2024). The Dynamic Role of Intellectual Capital in Moderating ESG Practices and Financial Performance in the Chinese A-Share Manufacturing Sector. The Singapore Economic Review, 1-27.

Kweh, Q. L., Ting, I. W. K., Lu, W. M., Asif, J., & Le, H. T. M. (2025). Environmental, Social, and Governance (ESG) and ESG Controversies: Opportunities or Challenges in Achieving Firm Efficiency?. In Natural Resources Forum. Oxford, UK: Blackwell Publishing Ltd.

Le, H. T. M., Cheng-Po, L., Phan, V. H., & Pham, V. T. (2024). Financial reporting quality and investment efficiency in manufacturing firms: The role of firm characteristics in an emerging market. Journal of Competitiveness, 16(1), 62.

Phan, H. V., Lai, C. P., Li, H., Le, H. T. M., & Nguyen, T. K. (2024). MAPPING THE INVESTMENT EFFICIENCY: A CO-CITATION ANALYSIS. International Journal of Industrial Management, 18(1), 60-71.

Kweh, Q. L., Le, H. T. M., Ting, I. W. K., & Lu, W. M. (2025). Family control, R&D expenses and firm efficiency: evidence from Taiwanese cultural and creative industries. International Journal of Emerging Markets, 20(1), 278-298.

Nguyen, H. T. T., Ullah, S., Le, H. T. M., & Hameed, A. (2023). Sustainability Targets in Executive Remuneration Contracts and Corporate Sustainability Performance in the United Kingdom and European Union. Environment Systems and Decisions, 43(3), 393-415.

Le, H. T. M., Ting, I. W. K., Kweh, Q. L., & Ngo, H. L. T. (2023). CEO duality, board size and firm performance: evidence in Vietnam. International Journal of Business Excellence, 29(1), 98-120.

Kweh, Q. L., Ting, I. W. K., Lu, W. M., & Le, H. T. M. (2022). Nonlinearity in the relationship between intellectual capital and corporate performance: Evidence from Vietnamese listed companies. Journal of Intellectual Capital, 23(6), 1246-1275.

Kweh, Q. L., Lu, W. M., Ting, I. W. K., & Thi My Le, H. (2022). The cubic S-curve relationship between board independence and intellectual capital efficiency: does firm size matter?. Journal of Intellectual Capital, 23(5), 1025-1051.

Ting, I. W. K., Chen, F. C., Kweh, Q. L., Sui, H. J., & Le, H. T. M. (2022). Intellectual capital and bank branches' efficiency: an integrated study. Journal of Intellectual Capital, 23(4), 840-863.

Ting, I. W. K., Kweh, Q. L., Asif, J., & Le, H. T. M. (2022). Intellectual capital and corporate profitability: zooming into value added intellectual coefficient. International Journal of Learning and Intellectual Capital, 19(5), 461-489.

Le, H. T. M., Kweh, Q. L., Ting, I. W. K., & Nourani, M. (2022). CEO power and earnings management: Dual roles of foreign shareholders in Vietnamese listed companies. International Journal of Finance & Economics, 27(1), 1240-1256.

Kweh, Q. L., Ting, I. W. K., Le, H. T. M., & Nourani, M. (2021). Nonlinear impacts of board independence on debt financing: Contingent on the shareholdings of the largest shareholder. International Journal of Finance & Economics, 26(2), 2289-2306.

…

6. Contact Information

Room B007, Faculty of Accounting, Ton Duc Thang University

No. 19, Nguyen Huu Tho Street, Tan Phong Ward, District 7, Ho Chi Minh City, Vietnam

Phone number: 028.37755034

Email: khoaketoan@tdtu.edu.vn